Loans & Deferred Loans

- How to Qualify for a Deferred Loan

-

We offer deferred loans for ductless heat pumps, window replacement, and insulation.

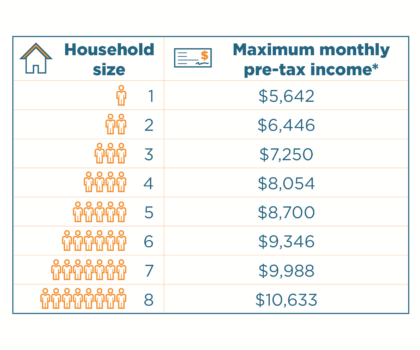

To qualify for a deferred loan, you must prove that 80% of your gross monthly income falls below the amounts listed in the following table. A 20% deduction credit will be applied to earned income and a 10% reduction to retirement income that is taxed at the time of payout.

If you are approved for a deferred loan, you will make no loan payments. However, you may have to pay a small fee depending on the type of work done to your home. The loan is paid back when the property is sold or changes ownership.

*Income qualifications are subject to change.

To apply for the deferred loan, you must provide income information for the past three months for each member of your household over the age of 18. Acceptable income documents include:

- Paycheck stubs

- Child support invoices

- SSI/SSDI award letters

- Retirement pension or IRA statements

- Interest, dividends or annuities statements

- DSHS documents such as Lifeline/GAU or TANF

- State Labor and Industry Veterans Affairs statements

- Unemployment compensation documents

- Rental property income documents

- Self-employment income verification

If any members of your household are older than 18 and listed as having zero or undeclared income, you must explain in a written letter how they currently meet their basic living needs such as food and shelter.

- How to Apply for a Deferred Loan

-

1. Contact a Tacoma Power Participating Contractor to schedule a free estimate. They can also evaluate your home to help determine which of our programs best meet your needs. This contractor can also help you complete the Deferred Loan Application including determining if you will have to pay any costs for the work.

2. Review a checklist of required paperwork.

3. Complete the Deferred Loan Application, declaration or zero or unreported income (if applicable), and Tacoma Power Residential Programs Application and submit it in one of the following ways:

- Have your contractor submit it directly to Tacoma Power on your behalf.

- Email the application and all relevant documents to rebates@cityoftacoma.org.

- Fax the application and all relevant documents to 253-502-8572.

- Mail it to Tacoma Power, CEP – Main Lobby, 3628 S. 35th St., Tacoma, WA 98409-3192.

- Drop it off in the Conservation Lobby at the TPU main office at 3628 S. 35th St., Tacoma.

It usually takes four to six weeks to process your application. For assistance, please call 253-502-8363.